Investing in real estate is a great way to build wealth and diversify a portfolio of investments.

INVESTING IN CHICAGO REAL ESTATE

In this guide, you’ll learn some of the basics of what to look for in an investment property and also some of the specifics of what it means to invest in Chicago. The guide will specifically highlight multi-units in the Chicago area, as they are abundant and a unique market to navigate in Chicago.

This guide will outline the steps to a transaction, the different financial metrics to consider, and also some of the characteristics of a property that are important to evaluate. Whether you are looking to house hack, maintain a turnkey rental property, or take on a full rehab, this guide is for you. The Kehoe Group and The Hoon Team specialize in multi-unit investment properties and can provide expertise whether you are a beginner or an experienced investor.

FINANCIAL BENEFITS OF REAL ESTATE INVESTMENT

Rental Income + Long Term Appreciation

The obvious starting point is the financial return of rents, but it is also important to consider the long-term appreciation of a building. Both aspects of a building can provide great return and should be factored in when weighing the risk / reward of a property. Property values have doubled or even tripled in the last 20 years within the Chicago area, and historically speaking, real estate tends to appreciate over the long term.

TAX ADVANTAGES TO PROPERTY INVESTMENTS

Several deductions can be made on your property, including:

- Interest accumulating on the loan

- Repairs and maintenance

- Property taxes

- Utilities (paid by you for tenants’ use)

- Advertising/Marketing

- Insurance: Homeowner’s and mortgage insurance premiums

- Travel expenses to/from your investment property

- Professional services, including a property management company, accountants, and attorneys.

- You may also be able to deduct part of your rental income from your taxes (if collecting rent through an LLC)

Depreciation

Every year the income property is owned, 1/27.5 of the property’s value can be written off against the income generated. So, for a multi-unit bought at $500,000, the purchase price would be divided by 27.5 to get $18,182 in depreciation. This is the amount you could write off the cash flow you earned for the year from that property.

THE LEVERAGE OF FINANCING

First and foremost, Landon Hoon and his team are the immediate resource to turn to with specific questions. Just as every property is unique, every person has a unique situation and The Hoon Team is the best resource in Chicago for finding the right loan product to fit your investment strategy.

There are several types of financing for an investment property. When most people think of a mortgage, they think of a Conventional 20% down payment. While this is great if you’re able to do it, your financing can vary quite a bit depending on your situation. As a pure investment, many lenders require anywhere from 20-30% down payment. As a primary residence, there is a much wider variety of financing options available. These options can change frequently as guidelines change, but here are some examples of current possibilities:

FHA Loan products are a great source of leverage, as they allow for a lower percentage down payment (as low as 3.5%). These types of loans have more restrictions, but when the right person and property qualifies for the FHA loan to be utilized, it can be extremely beneficial.

Another loan product that falls under the FHA umbrella is an FHA 203k Loan, which allows you to finance both the purchase of the property and also the rehab costs in one loan. The 203k loan has more guidelines than most other types of mortgages, but it is easy to see how this could be an optimal financial situation for the right person and property.

For an FHA Loan you are able to go as low as 3.5% down on 2-4 unit properties. For 3 and 4 unit properties, FHA has a self-sufficiency rule that the property must pass in order to obtain financing. The Rule: the market rent for all of the units x 75% has to be greater than your all-in monthly mortgage payment.

Example: 4-unit property with each unit at a market rent of $1,000 (or $4,000 total), the $4,000 x 75% = $3,000 has to be greater than your total monthly mortgage payment (principal and interest, taxes, home insurance, and mortgage insurance).

VA Loan : 0% Down

This is a loan for veterans, active duty military, and so on. This type of loan often has many benefits over the other loan types as long as you qualify (no mortgage insurance, typically lower interest rates, and are able to put $0 down in certain scenarios).

Loan Limit: No max loan limit

Physician Loan : 0% Down

This is for 1-2 unit properties. No mortgage insurance and 0% down.

Loan Limit: 1-2-unit: $750,000 with 0% down / 1-2 unit: $1,250,000 with 5% down

Portfolio Loans are specialized products that can change more frequently. The Hoon Team is able to offer these types of products due to their relationships with local banks and credit unions. The familiarity with the local market allows these institutions to feel more comfortable with a greater amount of risk.

Portfolio #1 : 5% Down

Home possible. If your income is 80% of the area median income, then you are able to purchase a home with a 5% down payment. This number is $72,960 in the Chicago-land area.

Portfolio #2 : 5% Down

This program is for two units only. If you are buying in a low to moderate-income area, then you are able to purchase a 2-unit with no income cap.

Portfolio #3 : 10% Down

Down payments as low as 10% to 2-4 units all throughout Chicago. There is no income cap on this program. The requirement is that the property must be within 100 miles of Chicago.

Additional Types of Down Payment Requirements

Conventional Primary Residence

2 Units 15% / 3-4 units 20%

FHA Primary Residence

1-4 units 3.5%

Conventional Investment Property

2-4 units 25%

What Is House Hacking?

House Hacking is buying a residential multi-unit property (2-4 units), living in one unit, and renting out the others to supplement your mortgage payment. Income from the rental units can pay for some, or all expenses while you live at the property. A house hacker may eventually move into another home and keep the property as a long-term rental investment.

House Hacking is an ideal investment opportunity for homeowners who are

willing to manage a building, be a landlord, and potentially forgo living in their dream home right away. The financial leverage created through some of the extra hustle and sacrifice of house hacking is an incredible way to generate wealth for the future.

The ability to minimize or possibly eliminate one’s housing expenses will free up income and allow greater financial freedom to invest elsewhere.

As referenced in the financing section, owner occupants have both lower down payment requirements, but also they generally are able to obtain lower interest rates and more attractive terms than investment financing. After moving out of the property, a house hacker will be able to maintain the initial mortgage terms, which provides an additional advantage to this type of investment.

Lastly, it is worth noting that house hacking provides education. House hacking is usually a person’s entry into the multi-unit market and helps a person to determine if real estate is the right investment strategy for them. It is wise to invest in what you know, and house hacking teaches a person the most about a property, including the best way to operate the building as an investment. Everyone makes mistakes while learning, but it’s easier to recover when on-site and personally involved.

Along with managing the building, house hacking will teach a person how to market rental units, select tenants, leverage / outsource maintenance and repairs, and manage their own time effectively.

QUESTIONS WORTH ASKING

One step of the buying process will be a consultation with The Kehoe Group. In order to best prepare for buying a multi-unit property, several questions need to be considered. Both the questions below, and many others will help shape the property search.

Do I plan on living at the property or buying as a pure investment?

Do I have a preference on neighborhood / location?

Is the school district, or crime rate, or proximity to public transportation important?

What financial metrics are important to me to gauge a good return (cap rate, GRM, annual cash flow, etc)?

What is my risk tolerance?

Is this a short term or long term investment?

Do I want a turnkey property, gut rehab, a place with at least some value add opportunity?

Is there a preference for a 2, 3, or 4 unit building?

What’s my budget for the purchase and for any potential rehab?

Is there a preference on how many bedrooms / bathrooms per unit?

Is there a preference for frame vs brick building?

Is parking important?

Have I considered the amount of rent I’ll be collecting, as well as all of the types of potential expenses?

Rental Income

01. Monthly Rent

02. Pet Fee / Rent

03. Parking Fee

04. Coin Laundry Income

Expenses to Consider

01. Mortgage Payment

02. Taxes

03. Property Insurance

04. Maintenance / Repairs

05. Electric

06. Gas

07. Water

08. Garbage

09. Property Management

10. Marketing / Advertising

11. Vacancy

TRANSACTION TIMELINE

A well-priced home creates interest, attracts buyers, generates showings, and produces offers in a shorter amount of time.

Mortgage Pre-Approval with The Hoon Team (unless paying cash)

Buyer Consultation with The Kehoe Group

Home Search Setup (in both MLS and Private Networks)

Between browsing and making an offer, you’ll see several properties. Visiting properties is extremely educational because with The Kehoe Group you’ll learn a lot. It is common that most first time investors will say ‘I don’t know what to look for’ or ‘I don’t know the right questions to ask’ when touring a building. That is exactly why you work with an expert. We are here to help you gain greater understanding of the entire process.

Make An Offer

Property Inspection

Attorney Review

You will have an attorney review contingency typically 5 or 7 business days to have an attorney review the contract after it is signed. During this time, your attorney will negotiate amendments to the contract as well as formalize any inspection repairs/ credits that the seller agreed to. During this time, all documentation is turned over (copy of leases, rent roll, building budgets, receipts from repairs, warranties, permits, etc.)

Loan Application and Appraisal

Clear Mortgage Contingencies

Final Walk-Through Of Property on Closing Day

Our 14-Step Marketing Plan will begin and we’ll be proactively communicating on a regular basis to keep you updated on the status of inquiries, showings, and feedback.

Closing

Estimated Costs

The following is an estimate of the costs typically associated with the purchase of a home. (Actual charges can be more or less).

Prior To Closing

Inspection for Multi Unit: $700 – $1200

Differs according to the size of the property.

Appraisal & Credit Report: $400 – $575

Paid to the lender.

Paid At Closing

Lender Processing & Underwriting Fees: $1,000 – $1,500

Lender’s Title Insurance Fee: $200 – $400

Ensures lender’s interest in the property is the first mortgage.

Title Company Fees: $3,000 – $4,000

Based on the value of the property.

Other

Chicago Revenue & Transfer Stamps: $7.50 per 1,000 on purchase price.

Property Insurance: Varies based on the property.

Tax Reserve Fund

A minimum of two months of estimated taxes placed into escrow if required by the lender, depending on the timing of closing.

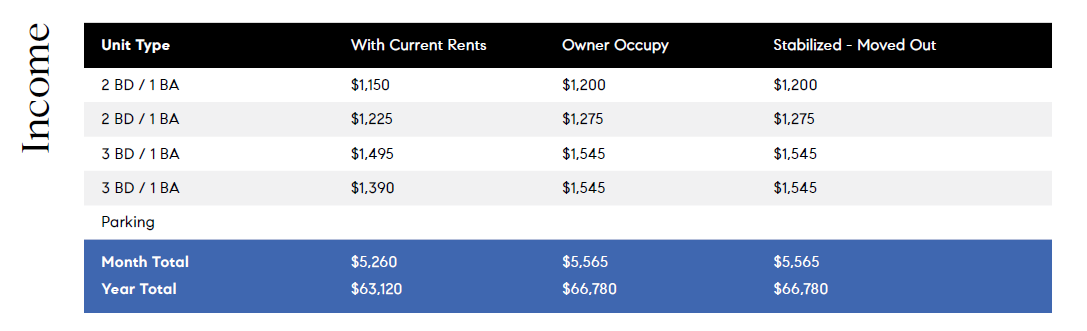

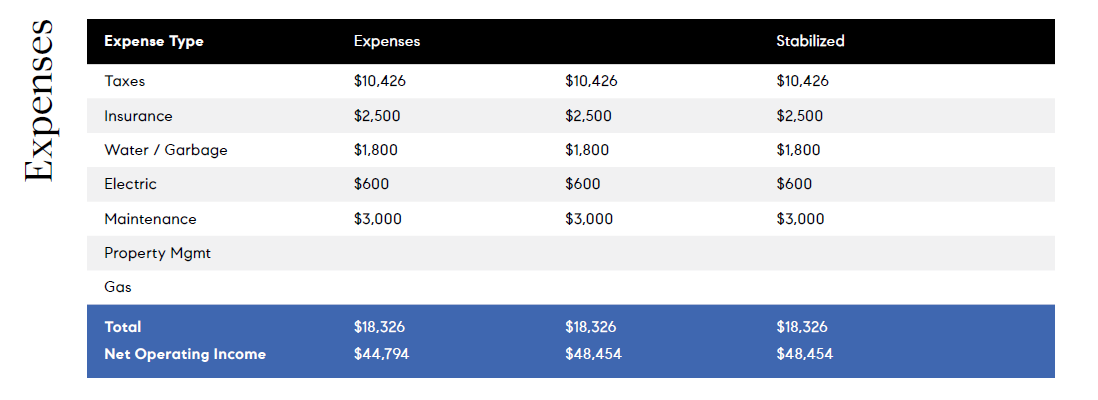

A Real Life Example

It may help to see a real example of a property and evaluate the numbers. Here is a real property that a client was considering in the Avondale neighborhood. While the build-out of a pro forma could be extensive and include every possible variable, it is best to get a general idea of how the building can perform as an investment in order to be able to make a decision (especially in a competitive market).

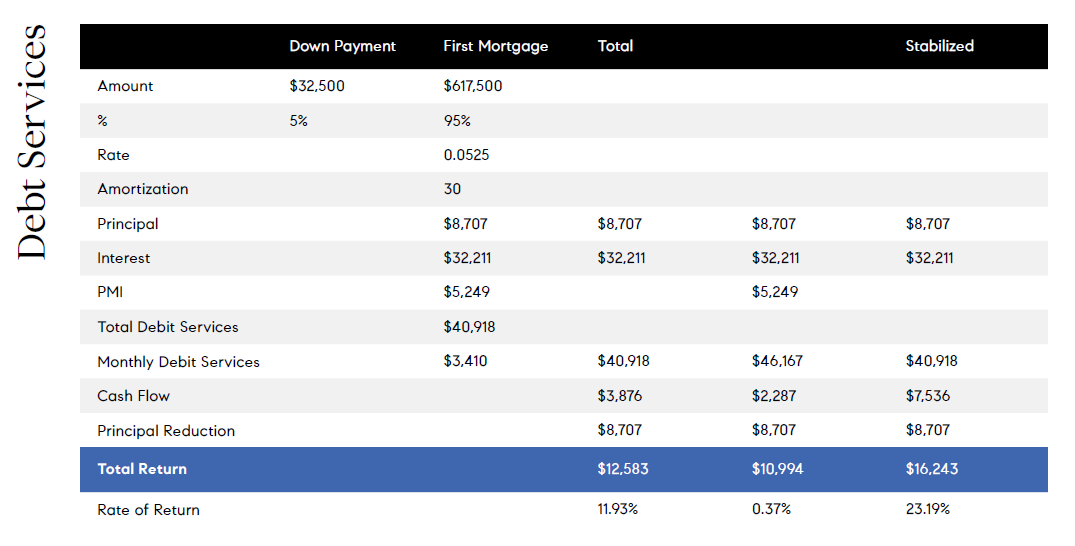

In this situation, the buyer was looking for more of a house hacking situation. They wanted to buy a three or four unit building. The objective was to live in one of the smaller units and supplement the mortgage as much as possible. We found a four unit building and built out the numbers so that they would live in a two bedroom, one bath unit. The way we built out the numbers showed that they would essentially be paying themselves rent of $1,200. As you can see, this would leave them with a positive cash flow of $2,287 annually.

With a down payment of $32,500, this client was able to purchase a property worth $650,000 and have a very minimal monthly payment. After moving out and getting all units rented, they realized a profit of $7,500 per year.

In this situation, the return is incredible! After nearly 5 years, this investor recouped their initial investment (down payment) and had a strong, cash flowing building. One thing not shown in this case study is that the rent prices have improved more than expected, meaning cash flow is better and the overall property value has increased.

Price: $650,000

Units: 4

Price / Unit: $162,500

Current Cap Rate: 6.89%

Stabilized Cap Rate: 7.45%

GRM: 10.29784537